Trading With E.U. rope (28 Members, including U.K.)

The E.U. ropean Union, has been described as the “world leader in exports and top market for 100 countries”. Trade between the U.S.A. and the E.U. generates one-third of total goods and services traded and nearly half of global economic output. Traditionally the E.U. Member States have tended to trade goods with each other than with countries outside the E.U. , although there has been some change in recent years.

The E.U.-28 accounted for a 23.8 % share of the world’s GDP in 2014. This market is made up of a population of 743.1 million people, currently including U.K., however, post Brexit in 2018, the region will have 66 million less people.

E.U. policymakers see the promotion of international trade as a key driver of economic growth and job creation within the E.U. ’s internal market according to E.U. roStat.

Services play a major role in competitive economies, particularly those that provide services to drivers of the economy, such: transport, communications and business services. International trade in services is key for some of the E.U.’s member states and increasingly are exports to developing nations, particularly in terms of construction related projects.

That being said, the value of international trade in services is typically less than the value of international trade in goods. The E.U. increasingly seeks to boost its trade in tangible goods or digital services, allowing for scale. This is part of its ‘common commercial policy’. The ‘E.U. ropean Commission’ negotiates trade agreements and represents E.U. rope’s interests on behalf of the E.U. Member States. The E.U. Treaty outlines policy. Key aims are full employment and social progress. How this works is set out thus: “to contribute, in the common interest, to the harmonious development of world trade, the progressive abolition of restrictions on international trade and on foreign direct investment, and the lowering of customs and other barriers’”.

The E.U. differentiates between goods and services in their statistics. While goods exports are noted here, it is also worth noting their information on imports and exports of services.

Goods Exports and Imports: The E.U. -28 accounts for Approx. imately 15 % of total global trade in goods. The value of this far exceeds trade in services (by about three times), given that services are often harder to trade across borders.

Top Exports Of The E.U., rounded up to Approx. imateestimations, given available data, 2016 value

- Machinery and Transport 42% /Approx. over E.U. 700B

- Other manufactured goods 22% / E.U. 400B

- Chemical and related products 18% / Approx. 350B

- Food, drink, tobacco 6% / Approx. E.U. 150B

- Mineral fuels, lubricants 4% /Approx. E.U. 75B

Top Imports of the E.U. (Rounded up and Approximate figures, 2016 value)

- Machinery and transport : Approx. E.U. 550B

- Other manufactured goods: Approx. E.U. 450

- Mineral fuels and lubricants: Approx. U. 250

- Chemical and related goods: Approx. U. 190B

- Food, drink, tobacco: Approx. E.U. 100B

Main trade links and trade partners in % proportion of export trade – 2016

- S. in 2016: 20.8 %

- China 2016: 7%

- Switzerland 2016: 8.2%

- Turkey: 5%

E.U. Key Trade partners are as follows.

E.U. Export partners by value in 2016 (in E.U. ros):

| · United States |

362,042,620,926 |

| · China, People’s Republic of |

170,136,073,985 |

| · Switzerland |

142,432,192,176 |

| · Turkey |

78,029,673,940 |

| · Russian Federation |

72,428,109,201 |

| · Japan |

58,135,905,083 |

E.U. Imports by value (in E.U. ros) in 2016

| · China, People’s Republic of | 344,642,477,025 |

| · United States |

246,774,031,705 |

| · Switzerland |

121,607,652,144 |

| · Russian Federation |

118,660,695,234 |

| · Turkey |

66,651,616,689 |

The seven largest destination markets for E.U. -28 exports of goods account for over half of all E.U.-28 goods exports i.e. 53.5%. The top seven export and import partners are: the United States, China, Switzerland, Turkey, Russia, Japan and Norway. Although the seven largest destination markets for E.U. -28 exports are the same as those from where E.U. imports come, their relative position of significance varies.

Service Exports: From 2010 to 2015 the E.U. -28’s exports of services to non-member countries has been increasing, from E.U. R 569 billion (i.e. where a billion is 1,000,000,000, or one thousand million) in 2010 to E.U. R 832 billion in 2015. In 2016 provisional figures suggest a slight fall to E.U. R 820 billion.

Service Imports: However, imports of services by non-member countries rose from E.U. R 461 billion in 2010 to E.U. R 690 billion in 2016, resulting in the surplus for trade in services increasing from E.U. R 108 billion to E.U. R 130 billion.

The United Kingdom is the E.U. Member State with the highest value of exports of services to non-member countries, (E.U. R 183 billion of exports equivalent to 22 % of the E.U. -28 total in 2016). The next highest level of service exports to non-member countries was recorded by Germany (E.U. R 126 billion), followed by France (E.U. R 96 billion), Ireland (E.U. R 65 billion) and the Netherlands (E.U. R 56 billion).

Ireland had the highest level of services imports from non-member countries, these being valued at E.U. R 121 billion or 18 % of the E.U. -28 total; Germany (E.U. R 117 billion), the United Kingdom (E.U. R 94 billion), France (E.U. R 80 billion) and the Netherlands (E.U. R 74 billion) followed.

Key Categories of Service Exports and Imports:

- R & D

- professional and management consultancy

- technical and trade related services

- architecture

- engineering and scientific services

- waste treatment

- agriculture and mining

- other business services, including:

- distribution services for water, steam, gas and petrolE.U. m products, electricity

- air conditioning supply

- security and investigative services

- translation and interpretation

- photographic services

- building cleaning

- real estate

- other business services.

Transport was the second largest category of services exported by the E.U. -28 to non-member countries in 2016, valued at E.U. R 135 billion, i.e. 16 % of E.U. service exports in total. This was followed by travel at around 14 % of all services exported in 2011; in 2016 telecommunications, computer and information services represented 10 % of all services exports in 2016 and financial services which represented 11 % of all services exports in both 2016.

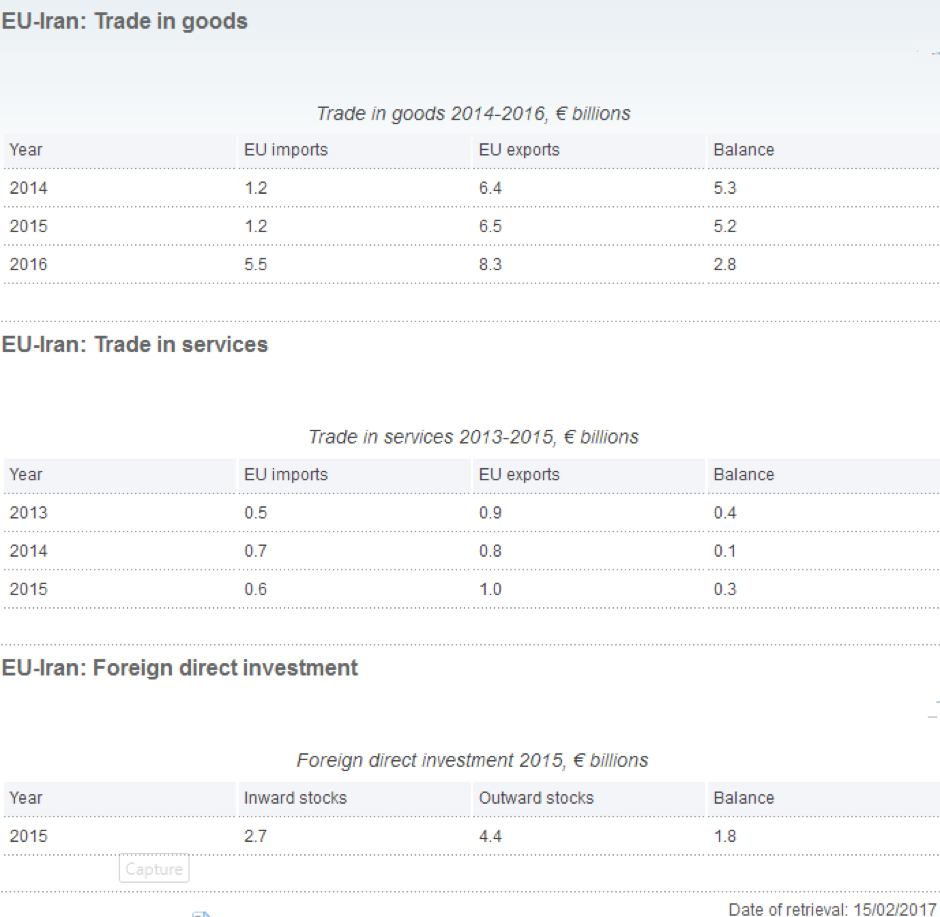

It is important to remember that E.U. sanctions against Iran were only lifted in 2016, so figures for trade between the E.U. and Iran are not yet available, but it is worth noting information about the trading bloc’s patterns of production and consumption.

Road Freight Networks in the E.U.

Border crossing points are too numerous to list, but the E.U. has common trade and tariffs across nations. We recommend you seek advice of one of our expert logistics consultants at Tehran Nasimfor E.U. ropean transit questions and international project management involving the E.U. .

It is useful to be aware of the strategic priority given to inter-modal transport, known as theTEN-T multi-modal networks as follows:

|

Trans-E.U. ropean Combined Transport network

Trans-E.U. ropean road network Trans-E.U. ropean Rail network Trans-E.U. ropean high-speed rail network Trans-E.U. ropean conventional rail network Trans-E.U. ropean Inland Waterway network and inland ports Trans-E.U. ropean Seaport network

Motorways of the Sea Trans-E.U. ropean Shipping Management and Information network

Trans-E.U. ropean Airport network Trans-E.U. ropean Air Traffic Management network Single E.U. ropean Sky and SESAR

Trans-E.U. ropean Positioning and Navigation network, including Galileo

|

Road Freight Transport Across the E.U.

The Trans-E.U. ropean Transport Networks (TEN-T, as in the illustrative maps) are a planned set of road, rail, air and water transport networks in the E.U. ropean Union. Within this, road freight logistics hubs are too numerous to list individually.

The international E-road network is a naming system for major roads in E.U. rope. It numbers roads with a designation beginning with “E” (such as “E1”). See Maps for scope. These main arterial routes are often complemented by well-maintained smaller roads, particularly in Western E.U. rope.

Rail Freight Transport Across the E.U.

The E.U. region is well served by high speed railway networks, including the TEN-T described above. Electrification and high speed are common in the region.

Rail links connect most major cities in E.U. rope and are too extensive to list. However, refer to high speed railway network maps and seek advice on locations not covered by these networks, as most cities will be served by rail networks, or road at least.

Ocean Freight for the E.U.

We omit U.K. ports from this analysis, given British exit from E.U. in 2018, but will bring more information on this country imminently.

The Trans-E.U. ropean Transport Networks (TEN-T) are a planned set of road, rail, air and water transport networks in the E.U. ropean Union. This includes some of the trading bloc’s key ports such as:

Rotterdam, Amsterdam, Hamburg, Bremerhaven, Zeebruges, Le Havre, Dunkerque. However, E.U. rope is well-served for both ocean freight and transit via rivers and even canals.

The TEN-T multi-modal and integrated transport networks have prioritised sea routes for development, as follows:

- The Baltic-Adriatic Corridor

- The North Sea-Baltic Corridor

- The Mediterranean Corridor

- The Orient/East-Med Corridor

- The Scandinavian-Mediterranean Corridor

- The Rhine-Alpine Corridor

- The Atlantic Corridor

- TheNorth Sea-Mediterranean Corridor

- The Rhine-Danube Corridor

There are ten Pan-E.U. ropeanCorridors, which are routes between major urban centres and ports, mainly in Eastern E.U. rope, identified as requiring major investment.

Logistics Issues for Trading With the E.U.

Seasonality issues do need to be taken into consideration when transporting goods in the E.U. region. However, given how well the region is networked, there are generally always alternative routes if weather becomes inclement – snow and ice being the most serious risks to schedules.

This is a vastly variable region. Temperatures, rain and snowfall can vary dramatically between the regions and even across countries.

Four seasons occur in Eastern E.U. rope. Southern E.U. rope has distinct wet season and dry seasons, with hot, dry conditions in summer.

Central and Eastern E.U. rope is not as mild as Western coastal areas and experience more frequent snowfalls.

The River Danube region through the Balkans, Ukraine and Southern Russia have cold winters and hotter summers.

The E.U. ropean Monsoon (the Return of the Westerlies) brings westerly winds during the E.U. ropean winter, but ease as Spring approaches through April and May.

In June storms and lower than average temperatures, fierce rain or hail, thunder and strong winds come.

The coldest winters are mostly found in Russia, with daily highs in winter averaging 0oC.

The Netherlands experiences tornadoes, but most are small.

In Summary, the E.U. is a huge market, supported by a highly developed infrastructure network. While trade tariffs are unified across member states, (currently 28, with the U.K. and excluding Turkey, who is not a full member), some administrative issues still apply when establishing trade partners in the region. For this reason, we recommend getting reliable advice from a logistics consultant at one of Tehran Nasim’s numerous offices.

It is worth noting, that on the continent, there are also countries who remain independent of the E.U., such as Switzerland, Austria and others. These are also key markets worth investigating.

Geopolitical Considerations For Trade With E.U. rope

The E.U. ropean Commission transport policy supports multimodality, improved logistical integration of transport modes and establishing interoperability at all levels of the transport system, underpinned by assumptions of trade with minimal barriers.

Recent events surrounding the end of the so-called Caliphate of ISIS mean that attacks on transport infrastructure are happening within E.U. rope nowadays. However, most attacks are prevented by interlinked security intelligence sharing and co-operation with local communities is increasing, improving deterrence.

In the past, however, E.U. ropeans have experienced other terror attacks, which has created a preparedness on transport planners’ part.

E.U. ropean transport users expect transportation networks in E.U. rope to be safe. The E.U. ropean Commission, responsible for policy, develops standards across the E.U. for safety and security in all modes of transport.

E.U. ropean Railway Agency (ERA), E.U. ropean Maritime Safety Agency (EMSA) and the E.U. ropean Aviation Safety Agency (EASA), are bodies set up to be responsible for the rail, maritime and aviation, sectors respectively.

Road

Road freight transport is the most common transportation mode. Rules and technical standards apply to minimise road accidents.

Rail

E.U. rope’s railways are among the safest in the world due to high standards and aligned safety requirements across the E.U. . This is part of the regional Single E.U. ropean Railway Area strategy.

Maritime

In maritime transport, safety covers passenger and merchant ships. Several major shipping accidents led to particular regulatory requirements being expected from shipping freight companies.

Air

Aviation in E.U. rope is one of the safest and fastest growing forms of transport. Procedures facilitate the free movement of products, services and persons involved in civil aviation, while ensuring safety.

Safety standards mean that there is a list of airlines banned or restricted from E.U. skies which is constantly updated. At present, several Afghan and Kyrgyz Republic airlines are on that list. Also,

Iran AsemanAirlines is not permitted to run flights in the region. If you are organising air freight, there are numerous options, so it is worth checking with a reliable logistics provider to avoid delays.

Transport security in the E.U.

Transport security policy balances protection from attack with free movement. Acts of terrorism are rare events, but networks are increasingly a target for such actions. Other forms of security threats to transport are more common, e.g.: break-ins, stowaways, robbery of valuable cargo in transit, or piracy on the high seas.

The E.U. ensures a coordinated approach to security standards being developed via bodies such as the International Civil Aviation Organisation and International Maritime Organisation. There is also cooperation with third parties on transport security, so the E.U. ropean Commission works with major international partners, exchanging knowledge, experiences and best practices.

New technologies are also increasingly adopted to operate sophisticated, busy and smooth high-security systems for the future; duration and intensity of security checks are a key consideration.

The E.U. lifted sanctions on Iran in 2016 and E.U. ropean companies have been establishing protocols and negotiating contracts. In the short space of time since January of 2016, hundreds of millions of dollars’ worth of bilateral contracts have been agreed.

Geo-Political Considerations for Trade With E.U. rope

The E.U. ropean Commission states the following regarding international trade:

“E.U. trade policy helps to create new jobs and new trade and investment opportunities for companies, big and small. For consumers, trade agreements cut prices and widen choice, while keeping the E.U. ‘s high standards for consumer protection, social rights and environmental rules.

Our trade policy also boosts E.U. rope’s influence in the world, project our values and attract more investment.

Trade agreements help us achieve all these goals.”

It also recognises that there are protectionist dynamics at play in current markets and seeks to take an opposite stance in this sense. However, the E.U. imposes sanctions on Russia, a key trading partner of Iran; this has implications for shipping logistics transiting through that nation. Also, there are still some limitations in terms of Iranian companies trading with the E.U., given the need to convert currencies into the USD to make payments. However, many global brands, operating in E.U. rope have been forging trade agreements with Iran since the easing of sanctions in January 2016, in the expectation of full resolution of financial logistics imminently.

The Joint Comprehensive Plan of Action, agreed multi-laterally in July 2015 in regard to Iran established a new basis for trade.

The JCPOA sets limits to Iran’s nuclear programme and established monitoring and transparency protocols, in exchange for the relief of existing UN sanctions, including on trade. The JCPOA lead to the UN beginning to lift some sanctions in January 2016. This, according to the E.U., opens up “…the possibility of a gradual but substantive reengagement with Iran at different levels, including bilateral trade.”

Currently, the E.U. is only the fifth largest trade partner of Iran, accounting for 6% of trade with Iran. Before sanctions, the E.U. used to be the country’s main trading partner. In 2016, the balance in trade with Iran was valued at €2.7B. Trade balances for the previous 10 years with Iran were mostly negative. E.U. exports of goods to Iran in 2016 was over €8.2B. The main exports are mainly machinery and transport equipment (€3.8B / 46.2%), chemicals (€1.8B /22.2%) and manufactured goods (€0.7billion, 8.8%).

E.U. imports from Iran amounted to almost €5.5 billion worth of goods. Iranian exports to the E.U. are energy-related (mineral fuels account for €4.2B and 77% of E.U. imports from Iran), followed by manufactured goods (€0.4B / 8.5%) and food (€0.3 billion / 6.8%).

In 2016, Iran’s exports to the E.U. increased by 344.8% and E.U. exports increased by 27.8%.

All this increased trade, in spite of the fact that Iran is not a WTO member, nor is there any bilateral agreement between the E.U. and Iran! The E.U. supports Iranian accession to the WTO, which they see as a necessary step for Iran’s global trade. Whether or not this happens in the future, we will continue helping many of our clients establish international trade expansion projects into E.U. rope.

If you have questions about any of the above, don’t hesitate to contact one of our many experienced logistics consultants who can help your cargo get on the road to this huge regional market.

Reader Note: The views expressed in this article do not necessarily reflect those of Tehran Nasim